Your credit score is one of the most critical numbers in your financial life. It’s a reflection of how responsible you are with money and it can determine your ability to get a loan, a mortgage, or even a job.

This article will walk you through everything you need to know about your credit score, including what it is, why it’s important, and how to make sure it’s as high as it can be.

What is a credit score?

A credit score is a three-digit number representing your creditworthiness, or how likely you are to repay a loan on time. The number is generated by the credit bureaus and is a numerical summary of your financial history. It includes everything from your current and past debts to your payment history.

Whenever you need to take out a loan or set up a payment plan for something like a cellphone, the company will check your score to determine how likely you are to pay on time.

What is a credit bureau?

A credit bureau is a company that collects and maintains your credit history and evaluates your creditworthiness. There are two major credit bureaus in Canada: Equifax and TransUnion. They each generate a credit score for you based on your financial history. These scores are based on automated credit scoring models that help take the emotion out of the analysis.

Other companies pay these firms for the right to access your credit information to evaluate whether you are likely to be a good customer.

Why are credit scores important?

Your credit score is important because it quickly summarizes your credit health. High scores mean you’re a low-risk borrower, which could lead to lower interest rates and better loan terms. Low credit scores could make it harder for you to get a loan and can even make them more expensive.

Many other companies will also check your score as part of their internal processes. This includes banks, credit card companies, telecom companies, and even landlords.

If you’re trying to get a loan or rent a house/apartment, you should be prepared for a credit check. And when this check happens, a poor credit score could cost you more money on the loan or cause you to miss out on a great place to live.

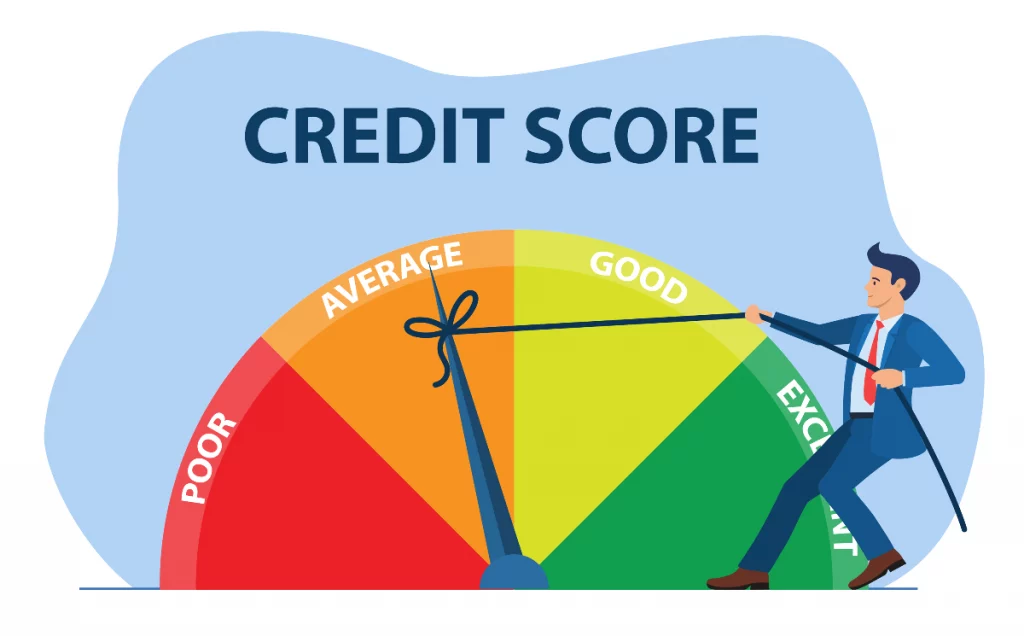

What is a good credit score?

A credit score ranges from 300 to 850. Of course, credit scores can look different depending on the credit agency used.

Generally, a good credit score is 700+, meaning you have an excellent credit history and are considered a low-risk borrower. Those in the 620-699 range might be starting to build their credit history. Finally, those below 620 will face far more difficulty securing loans of any kind (except for some secured loans like home equity lines of credit).

Here’s a quick reference to help you

- Above 700 = Good credit score

- 620-700 = Average credit score

- Under 620 = Risky credit score

What factors influence your credit score?

Many factors can influence your credit score. These factors are each analyzed by the credit agencies to develop a single credit score assigned to your account.

The amount of credit you have

The first factor is the total amount of credit you have. Just add up the credit limit on each of your open accounts (bank accounts, unsecured credit cards, etc.). This total amount of available credit is used when calculating the score.

The amounts you currently owe

The next item is the amount currently owing. The credit bureaus look at the total amount you have left to pay off as a percentage of your total credit. This is known as your utilization ratio (or credit utilization rate) and indicates whether you might be at a higher risk of paying back your debts.

Your payment history

Next is your payment history. More specifically, agencies are interested in whether you make your payments on time. Someone who is late making principal or interest payments could be seen as higher credit risk and thus have a lower credit score.

How long you’ve maintained credit

The duration of time that you’ve had your credit matters as well. Someone who has maintained their credit for long periods without having a credit card shut down or a line of credit revoked will be seen as more trustworthy in the eyes of lenders.

The types of credit you have

The types of credit you have are also important in terms of credit scoring. This is known as your credit mix. If you have credit that is considered “good credit,” such as mortgages or student loans, that shouldn’t harm your score. However, if you have “bad credit,” such as high-interest rate credit cards or payday loans, it can have a negative impact on their scoring models.

New credit inquiries

Finally, when you request new credit through a company such as a bank, that company will do what’s called a credit inquiry. This is where they check your credit report to see if you would be a good customer. While this is totally normal in most circumstances, too many of these requests can knock down your score.

How can you improve your credit score?

You can do a few things to improve your credit score if it’s not where you want it to be.

Pay on time

The most important thing is to ensure you’re always paying your bills on time. This is the most significant factor in your credit score, so make sure you set aside enough money each month to cover your expenses.

Watch your credit utilization ratio

You should also try to keep your credit utilization ratio low. This means using less than 30% of the total credit available to you on your accounts.

Be consistent

Finally, having a long history of good payment behavior will help improve your score over time. The longer your positive track record, the better the odds of having a good credit score.

How to get a free copy of your credit report

Each of the Canadian credit agencies offers free credit reports that include their credit scores so that you can check your personal situation.

You can request your free credit score on their website, phone, or in person. The links below will take you directly to their sites so you can start the process right away.

Remember, getting your free score is the first step toward understanding whether you have a problem or not. After you know what the data looks like, you can take the steps needed to start making changes (if needed).

How to dispute inaccurate information on your credit report?

If you find inaccurate information on your credit report, you can dispute it with the credit agency. This process is relatively easy, and the bureau will investigate the claim.

You can start by filling out their online form or calling their customer service line. They will ask for some basic information about yourself and the disputed item.

Once they have all of the information, they will investigate the claim and let you know the outcome. If the item is inaccurate, they will update your credit report to reflect that. If not, they will let you know the reason for their decision.

If you are still unsatisfied with the outcome, you can submit a complaint to the credit bureau’s regulator or contact a lawyer for legal advice on your options going forward.

However, it is much easier and less expensive to dispute incorrect information directly with the credit agency.

What to do if you need more help?

Sometimes, it isn’t enough to just review and understand your report. Maybe you haven’t been making timely payments on your car loan. Perhaps you’re worried about your financial health. Maybe you have poor credit, and you don’t know what to do.

If you fall into any of these categories, here are a few options that can help you get a higher credit score.

Look for a credit counseling service

A credit counseling service can help you create a plan to get your credit accounts back on track. They may even be able to negotiate with your creditors on your behalf.

You can find a credit counseling service in your area by doing a quick Google search or contacting the Credit Counselling Society.

When you meet with a credit counselor, they will review your financial situation and create a specific plan. This may include creating or updating a budget, negotiating lower interest rates, and setting up a payment plan.

They will also work with you to create achievable and realistic goals. Remember, the goal isn’t to get immediate results but to set yourself up for long-term financial success.

Talk to a credit repair service

If you need more help getting your credit fixed and improving your score quickly, a credit repair service may be right for you.

Credit repair services work by helping you dispute negative items on your credit report or verify their accuracy. They will also work with creditors and lenders to negotiate better terms on your behalf, so you get back to building credit.

Some services are free, while others charge a monthly fee, so make sure to do some research before choosing one that fits your needs best.

Overall, these services can be a great way to get back on track with your finances and achieve all of the goals you have set for yourself.

Final thoughts

Your credit score is an important number that affects many parts of your financial life. It’s crucial to understand what goes into your score, how to improve it, and the steps you should take if you find inaccurate information on your credit report.

Remember, the best way to protect and improve your credit score is by being proactive. Review your credit report regularly, make timely payments on your accounts, and avoid taking on too much debt.

Doing these things will improve your score and help you build a solid financial foundation that you can rely on for years to come.