In a real financial pinch, it can be difficult for some people to quickly find financial resources they can use to get out of trouble or handle emergencies. Under the right circumstances, borrowing money commercial lenders might be an option. However, people struggling with their finances don’t always have the option of borrowing from standard commercial lenders because of credit (CR) or credit score issues. In such cases, visiting a payday lender starts looking like a good option.

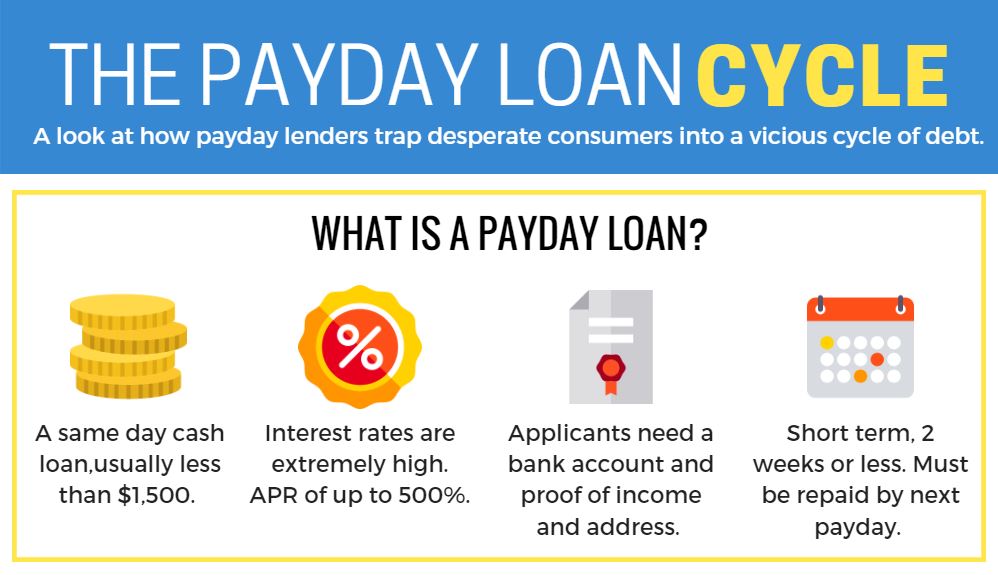

There is no doubt that payday loans or advances are convenient. Payday lending companies can usually approve applications in a matter of minutes. They seldom require anything more than proof of employment in the form of a current paystub, and it is very rare for them to even run a credit report. You might be wondering, “why would a payday lender be willing to take such a risk?”

The answer is easy. The fees they collect and the exorbitant interest rates they charge on loans more than makeup for any defaults that might come their way. It’s strictly a volume business. They accept lots of customers, charge outrageous fees and interest, and bank on most people paying off their loans and reapplying shortly after their loan comes due. Experts refer to this as the “payday loan cycle.”

Before you get yourself involved in the payday loan cycle, you might want to consider that doing so could result in you encountering major financial issues later on. If not careful, you can get yourself involved with payday loans or advances and end up hurting your credit.

Understanding Your Credit Score

Before discussing exactly how payday advances can hurt your CR score, we at SkyCap Financial want you to understand how the relevant parties will calculate your score. The fact is most consumers have little knowledge about how their score is calculated and gets reported to Canadian end-users like Equifax and TransUnion.

The first thing you need to know is there are a lot of reporting companies out there that have access to your “FICO” score.

The organization that provides your borrowing statistics to the CR reporting bureaus is the Fair Isaac Corporation (FICO). To calculate your actual FICO score, the company uses the following weighted data:

- Payment history is 35%

- Accounts owed is 30% (outstanding loans)

- Length of credit history is 15%

- New loans and inquiries are 10%

- Debt mix is 10% type of debt)

Once a Canadian reporting agency gets your borrowing data, they then calculate their version of your CR score. This typically ranges from 300 to 900 in Canada. For what it’s worth, 670 and above is a good score. Anything less than that and you will likely have borrowing issues.

How Payday Loans Can Hurt Your Credit

To be clear, you securing a payday loan is not likely to affect your credit score one way or another. Why? Payday lenders don’t often do any reporting to credit bureaus. They don’t typically report the existence of a loan nor do they report payment history. It’s only when a borrower’s account becomes problematic that one’s score could get hurt.

It’s important to remember that we at SkyCap are not referencing large amounts of money here. These loans or advances typically range from $100 to around $500 with the higher amount being the most common amount people borrow. The loans are typically in place for no more than a couple of weeks (standard pay period) before coming due. Still, these short-term loans or advances for small amounts can hurt someone’s credit if there are any residual repayment issues.

At this point, we want to layout the three primary ways payday loans can hurt your CR rating.

Going to a Debt Collector

While payday loan companies don’t typically report to the CR rating bureaus, debt collectors always do. If a payday loan company has difficulty securing payments on outstanding loans or advances, they won’t hesitate to turn the debt over to a debt collector.

They do this because they make money by running a lean business model. They don’t want to invest a lot of money on staffers who would be doing nothing more than sitting in an office, trying to collect on past due accounts. Remember, the exorbitant fees and interest they charge you give them lots of room to settle for less on the dollar from a debt collector. This process is going to hurt your credit.

Possible Lawsuits

A lot of the larger payday lenders maintain in-house counsel. This affords them more leeway to file lawsuits as opposed to using debt collection agencies. If they were to file a lawsuit against you and you lose, the loss becomes public record. When this happens, it would likely be picked up in your FICO score calculation. If and when that happens, you can bet it’s going to hurt your score.

Creating Other Payment Problems

We see it time and again. Someone gets caught in the cycle of continually visiting payday loan companies and eventually, the high fees and interest drain their monthly financial resources. When this happens, it puts their other debt payments at risk.

You need to know that while payday lenders don’t typically report payment history, credit card and mortgage lenders do. If you were to get yourself into financial difficulties due to trying to pay your payday advances, it could be just a matter of time before you put all of your other debt at risk. If you miss payments on your debt, you can expect your FICO score to take a significant hit.

A Solid Borrowing Alternative

Before you hit the panic button due to financial problems, you need to know you can likely get access to better loan alternatives. You owe it to yourself to do all you can to avoid those crazy fees and interest rates.

At SkyCap Financial, we are offering short-term loans of up to $10,000 to Canadian residents. Through our fast and easy online loan application process, we can respond to your needs quickly. If approved, the rates we will be charging you are far better than you would get from a payday lender. By offering you more borrowing alternatives, you can choose one that you know you can manage. That could translate into you getting the financial help you need without hurting your credit score in the process.

at

how much is d interest, if someone want to collect like 150000

at

We dont provide loans of that size. We do smaller, personal loans up to $10,000.

The interest would be calculated over the term of borrowing as well.