When it comes to getting a loan, there are a lot of things to take into account. You want to ensure you’re getting the best deal for your needs, which can be difficult when you don’t know where to start.

That’s where SkyCap comes in. We’re here to help provide easy installment loans for borrowers of all types. We have a wide variety of options available, so whether you need a personal loan, a car loan, or even a mortgage, we can help. We also have a team of experts who are available 24/7 to answer any questions you may have

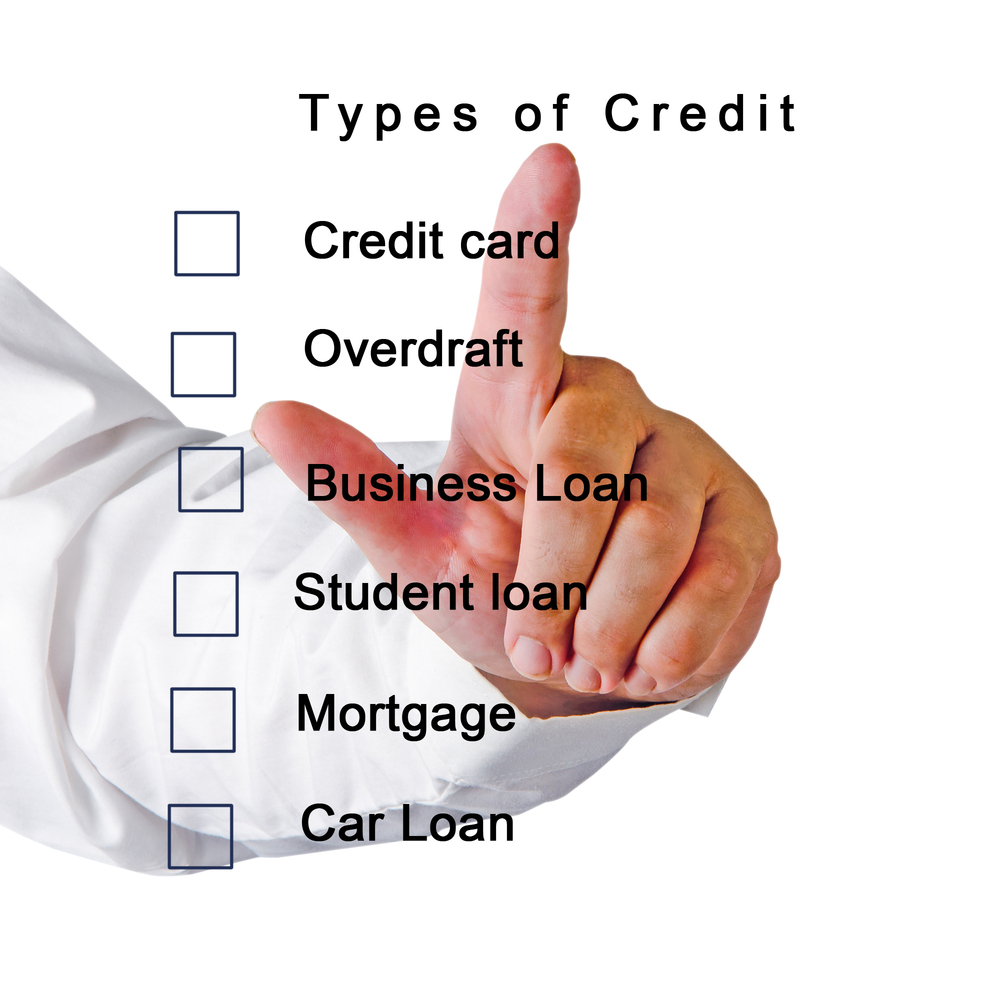

The Different Types of Loans Available in Canada

There are many different types of loans available in Canada, and each has its own set of benefits. Here are some of the most common options:

Personal Loans (aka an installment loan or online loan)

Personal installment loans can be used for a variety of purposes, including debt consolidation, home renovations, or even a vacation. They typically have lower interest rates than credit cards, and you can choose the repayment schedule that works best for you.

Payday Loans

Payday loans are designed to be repaid in full on your next payday. They can be a quick and easy way to get the cash you need in an emergency, but they typically have higher interest rates than other types of loans.

Mortgages

A mortgage is a loan that’s used to purchase a home. They typically have longer terms than other types of loans, and the interest rate is usually lower. To get the best rates, you’ll also need to put down a down payment, which is typically 20% of the purchase price of the home.

Car Loans

An auto loan is a loan that’s used to finance the purchase of a vehicle. The interest rate is usually lower than with other types of loans, and you can choose the repayment schedule that works best for you.

How To Find the Right Lender

There are many different lenders available, and it can be challenging to know which one is right for you. Here are some things to consider when you’re looking for a lender:

The type of loan you need

Not all lenders offer every type of loan. Make sure you find a lender that provides the type of loan products you need. For example, some lenders will only offer you a high-interest payday loan, while others will offer a cash loan or online personal loan. Seek the lender who is the best fit for your individual situation.

Your credit score

Your credit score will affect the interest rate you’re offered, as most lenders will run a credit check prior to approving your loan. This means a poor credit score will have an impact on the interest rate you can qualify for. Know your credit score before you apply for a loan. This will help you find the right lender for your situation.

The fees

Some lenders charge origination fees or prepayment penalties. These fees can substantially increase the overall cost of a loan and cause it to take longer to repay. Be sure to compare the fees before you choose a lender.

The interest rate

The interest rate is one of the most important factors to consider when you’re choosing a lender. Higher interest rates mean longer repayment windows. Make sure you compare rates from multiple lenders before you make a decision. Your bank statements will thank you.

The repayment schedule

Some loans have fixed repayment schedules, while others have flexible options. Depending on what you plan to use the money for, you may want to choose different options. For example, small loans are best paid off quickly, whereas larger loans (for cars, equipment, etc.) are best paid off over a longer period of time.

Insurance and loan protection

Some lenders offer an optional loan protection plan. This is a type of insurance that will pay off the balance of your loan in the event of your death or disability. Check to see if this is offered by your lender or financial institution before you sign up for your loan. This can be a great way to protect yourself and give you peace of mind.

The customer service and support

You want to make sure you choose a lender that offers top-notch customer service. Read reviews and compare lenders before you make a decision. If you have any questions, you can always reach out and request more information.

How to Apply for an Easy Online Loan

Applying for an online loan with SkyCap is easy. Just fill out our online application form, and one of our representatives will contact you to discuss your options. So whether you need a personal loan, a car loan, or even a mortgage, we can help you get your money fast. You can apply quickly and easily using our online application form.

How to Get the Best Interest Rates on Your Loan

Interest rates on loans can vary depending on the type of loan and the lender. Here are a few tips to get the best interest rates:

Research your options

Before you apply for a loan, research your options. There are many different lenders out there, and each one offers different interest rates. Compare rates from multiple lenders before you make a decision.

Know your credit score

Your credit score will affect the interest rate you’re offered by a lender. The higher your score, the lower the rate. Make sure you know your credit score before you apply for a loan so that you can find the lender that offers the best rate for your situation.

Shop around

Don’t just go with the first lender you find. Shop around and compare rates from multiple lenders before you make a decision. Taking out a loan is an important financial decision and not one you should rush into. Shopping around will help ensure your financial needs are met, and you don’t end up with buyer’s remorse.

Compare APRs

The APR (annual percentage rate) is the true cost of a loan, including interest and fees. Be sure to compare APRs when you’re shopping for a loan so that you can get the best deal.

The Requirements for Getting an Easy Online Loan in Canada

There are a few requirements you’ll need to meet in order to qualify for an online loan with SkyCap:

Citizenship and residency

SkyCap is only able to lend to Canadians or other permanent residents of Canada. This is due to the fact that we are only licensed to lend in certain Canadian provinces. You will need to provide this information as part of your personal loan application in order to get your money.

Age

You must be 18 years of age or older to take out a loan in Canada. If you aren’t yet 18 years old, you won’t be able to get a loan in Canada.

Income / Collateral

To get loans in Canada, you need to either have a job with regular income (which demonstrates your ability to repay the loan) or have some collateral you can use as a guarantee against defaulting.

Valid Contact Information

As part of the loan application process, you will need to provide a valid address, phone number, and email address before we can transfer funds for your loan.

Bank Account

Once we have approved your online loan agreement, we need to send you the cash. To do this, you will need to provide us with your bank account details as part of the application process so we can set up the direct deposit.

If you meet all of the above requirements, you can apply for an online loan with SkyCap. Just fill out our form to apply online.

What to Do If You Have Bad Credit

A bad credit score can make it challenging to get a loan, but it’s not impossible. There are still options available to you, even if your credit isn’t perfect. Here are a few things you can do if you have bad credit and need a loan:

Apply for a secured loan

If you have bad credit, one option is to apply for a secured loan. This type of loan requires collateral, such as a home or car. The lender will then use this asset as security against the loan in case you default. Because the lender has less risk, they may be more likely to approve your loan and offer you a lower interest rate.

Look for a co-signer

Another option is to find a co-signer for your loan. A co-signer is someone who agrees to repay the loan if you default. This can be a family member or friend. Having a co-signer with good credit can increase your chances of getting approved for a loan and getting a lower interest rate.

Apply for a smaller loan

If you have bad credit, you may want to apply for a smaller loan amount. This will decrease the risk for the lender and make it more likely that your loan will be approved.

Shop around

When you’re looking for a loan, it’s essential to shop around. There are many different lenders out there, and each one has different requirements. Some lenders may be more willing to work with you if you have bad credit.

Consider a payday loan

If you have bad credit, you may want to consider a payday loan. These loans are typically for smaller amounts, and they come with high-interest rates. They are also easy to qualify for. However, you should only take out a payday loan if you’re sure you can repay it on time. Otherwise, you could end up in a cycle of debt.

Bad credit can make it challenging to get a loan, but there are still options available to you. At SkyCap, we take pride in helping people with bad credit find an installment loan that will help them reach their financial goals.

How to Pay Back Your Loan

You will need to make regular payments on your loan in order to pay it back. The payment schedule will be determined when you take out the loan and will be based on your individual circumstances. You can typically choose to make weekly, bi-weekly, or monthly payments.

If you are having trouble making your payments, you should contact your lender as soon as possible. They may be able to work with you to create a new payment plan that is more affordable for you.

Some things to keep in mind when making your loan payments:

Set up automatic payments

This can help you ensure that your payments are made on time each month. When your payments are automated, you won’t run the risk of forgetting to make a payment on your online loan.

Make more than the minimum payment

If you can afford it, try to make more than the minimum payment each month. This will help you pay off your loan faster and save on interest.

Pay off your high-interest debt first

If you have multiple high-cost loans or other debts with high-interest rates, you may want to focus on paying those off first. This can save you money in the long run.

Making your loan payments on time is essential in order to avoid defaulting on your loan. If you default on your loan, this will damage your credit score and make it difficult to get a loan in the future.

At SkyCap, we offer flexible repayment options so that you can find a plan that works for you. We also offer discounts for early repayment, which can save you money in the long run.

If you have any questions about your loan or your repayment options, please don’t hesitate to contact us. We are here to help you through every step of the process.

Easy Online Loans Canada: Final Thoughts

Online loans can be a great way to get the money you need quickly and without having to go through a lot of hassle. At SkyCap, we offer online installment loans with flexible repayment options so that you can find a plan that works for you.

Ready to get started? You can apply online right now using our online application page.