It’s no secret that your credit score plays a significant role in your financial life. A good credit score can mean the difference between getting approved or denied for a loan or qualifying for lower interest rates and higher limits.

On the other hand, a bad credit score can make it challenging to get approved for any type of financing.

In this article, we’ll review what a credit score is, how it’s calculated, and the differences between a good one and a bad one.

Let’s get started.

What Is a Credit Score?

A credit score is a number that represents your overall creditworthiness. This number, along with your credit report, is created and maintained by a credit bureau. In Canada, there are two credit bureaus: Equifax and TransUnion, which are responsible for managing credit scores and credit reports for all Canadians. To do that, each bureau uses a credit scoring model to develop a unique score based on your information.

Lenders and credit card issuers use credit scores to evaluate your credit risk or the likelihood that you will default on a loan.

The higher your credit score, the lower your credit risk, and the more likely you will be approved for a loan.

There are many different credit scoring models, but the most common is the FICO score. The FICO credit score ranges from 300 to 850; the higher your score, the better. Today, the average credit score is around 700.

Understanding Good and Bad Credit Scores

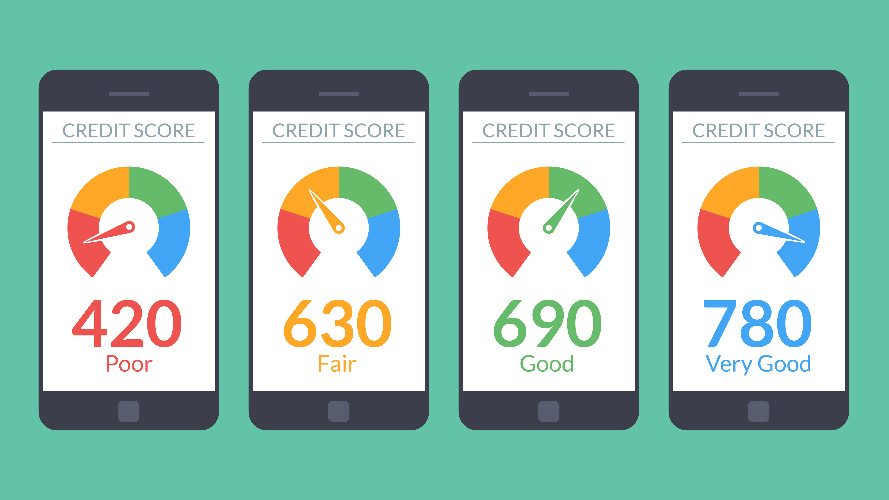

It’s important that you understand the difference between a good and bad credit score:

What is a good credit score?

Generally, a score of 700 or above is considered good, while a score of 800 or above is considered excellent.

Lenders with scores in the range should have no problem qualifying for a loan from most lenders, assuming there have been no recent changes to employment history.

What is a bad credit score?

A score of 650 or below is considered poor, and a score below 600 is considered bad. If you have a bad credit score, you are a high-risk borrower, and lenders may be reluctant to give you a loan.

That said, you may still be able to get a loan as many factors go into your credit score, including your payment history, credit utilization, credit mix, and length of credit history.

Why Having a Good Credit Score is Important

Bad credit can make it challenging to rent an apartment, get a cell phone plan, or qualify for a credit card. And, if you are approved for a loan with bad credit, you’ll likely face higher interest rates and fees.

For example, let’s say you want to take out a $3,000 loan with a 36-month repayment period. If you have excellent credit, you could qualify for an annual percentage rate (APR) as low as 6.99%.

However, if you have bad credit, you may be approved for a much higher APR that could result in thousands of dollars of additional interest over the life of the loan.

Understanding your credit score and credit report can help you take control of your financial future.

How Is My Credit Score Calculated?

Your credit score is one of the most critical pieces of financial information about you. It is a number that lenders use to decide whether to give you a loan and how much interest to charge you.

Most people generally understand how their credit score is calculated, but many factors go into it.

Here is a breakdown of the five main categories that make up your credit score:

Payment History

This is the most important factor in your credit score. It includes information about whether you have made your payments on time and whether you have missed any payments.

Credit Utilization

This is the second most crucial factor in your credit score. It measures how much of your available credit you are using.

Low credit utilization is vital so lenders see you as a responsible borrower.

Credit History Length

This is the third most important factor in your credit score. It measures how long you have been using credit.

The longer you have been using credit, the better it is for your score.

Types of Credit

This is the fourth most important factor in your credit score. It measures the mix of different types of credit you have, such as credit cards, mortgages, and auto loans.

Credit Inquiries

This is the fifth most important factor in your credit score. It measures the number of times you have applied for credit in the past 12 months. It is crucial to keep inquiries low because too many can hurt your score.

Now that you know the five main factors that make up your credit score, you can start working on improving your score.

What Do Lenders Look For In A Borrower?

When it comes to what lenders are looking for, there are a few things to know.

Your Credit Score

The first is whether or not you have a good or bad credit score.

If you have a bad credit score, this can be a red flag for lenders. They may be more hesitant to lend you money or offer you a reasonable interest rate.

Your Credit History

Another thing that lenders look at is your credit history.

This includes whether you’ve made on-time payments in the past, how much debt you currently have, and whether you’ve had any bankruptcies or foreclosures.

Lenders want to see that you’re capable of managing your finances responsibly, so a good credit history can go a long way in getting approved for a loan.

Income and Employment History

Finally, lenders will also look at your income and employment history. They want to make sure that you have a steady source of income and that you’re likely to be able to repay your loan.

If you have a history of job instability or are self-employed, this can be a red flag for lenders.

Overall, lenders are looking for borrowers who are likely to repay their loans on time and have a good credit history.

How Can I Improve My Credit Score?

If you’re working to improve your credit score, there are a few things you can do:

Make your payments on time

Making your payments on time is one of the most important things you can do to improve your credit score.

Late payments or missed payments on your credit accounts can significantly impact your score, so it’s essential to be diligent about making your payments on time.

Check your credit report for errors/inaccuracies

Your credit report is a record of your financial activity, so it’s essential to ensure there are no errors.

Regularly checking your credit report can help you spot any mistakes and ensure everything is accurate. It also helps you stay on top of any suspicious activity that could be a sign of identity theft.

Keep credit utilization low

Credit utilization measures how much of your available credit you’re using relative to your credit limit.

It’s best to keep your credit utilization below 30%. This shows lenders that you’re capable of managing your credit responsibly.

Limit your applications for new credit

Finally, limit the number of times you apply for new credit.

Every time you apply for a loan or credit card, it leaves an inquiry on your credit report. Too many inquiries can harm your score, so try to limit them as much as possible.

Improving your credit score can take time, but it’s worth it. A good credit score can help save you money and help you achieve your financial goals.

What Are the Consequences of Having a Bad Credit Score?

Having a bad credit score can have some significant consequences.

- It can make it harder to get approved for loans and credit cards, and you may not be able to get the best terms or interest rates if you are approved.

- Bad credit can also affect your ability to rent an apartment, buy a car, or even get a job.

- Some employers even check applicants’ credit histories when making hiring decisions, so having bad credit could put you at a disadvantage.

- Finally, bad credit can result in higher insurance premiums. Insurers often use your credit score to determine how much they’ll charge you for coverage.

Improving your credit score takes time and effort, but it’s worth it in the long run.

Conclusion

Understanding the difference between good and bad credit scores, how they’re calculated, and what lenders look for when considering a loan is essential.

Higher credit scores can mean the difference between getting approved for a loan and being denied or qualifying for lower interest rates and higher limits.

On the other hand, a bad credit score can make it challenging to get approved for any type of financing. So if you’re in the market for a loan, you must take steps to improve your credit score before applying.

If you have low credit or poor credit, SkyCap Financial can help. We provide installment loans to people with less-than-perfect credit, so we understand your situation. We can work with you to get the financing you need at a fair and reasonable rate. Apply now!