Today, many people are over-extended on their loans and credit cards. This means that there’s a generation of Canadians who may never be able to get out of debt.

If you are the type of person who has been paying off a loan with your credit card, debt consolidation may be able to help you.

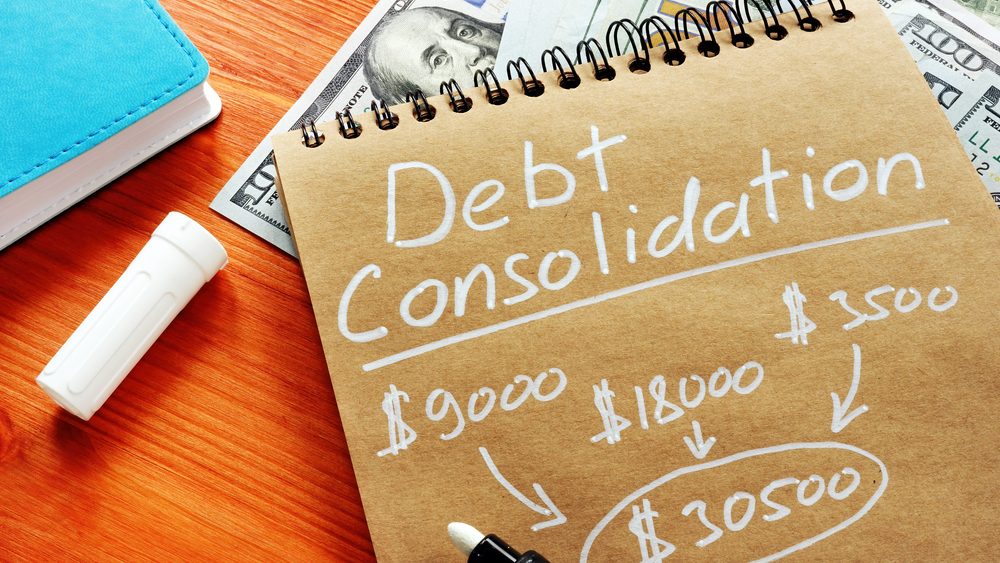

Debt consolidation is a tool borrowers use to reduce their monthly payments and regain control over their financial lives. It is a debt relief solution that improves your cash flow and moves you towards a debt-free life.

This article will review everything you need to know about debt consolidation and how it can help improve your financial situation.

What is debt consolidation?

Debt consolidation is the process of taking out a new loan to pay off multiple debts. This can be helpful in two ways: it can make your debt payments more manageable, and it can help improve your credit score. By consolidating your debts, you’ll get a lower interest rate and may even be able to get a longer repayment term.

If you’re thinking about debt consolidation, there are a few things you need to consider. First, you should ensure you’re getting a lower interest rate on the new loan than you were paying on the old loans. Second, you need to make sure you’re not extending the length of your repayment term too much – you don’t want to be debt free in 20 years! Finally, debt consolidation is only a good idea if you’re disciplined enough to stick to your repayment plan.

If you’re not sure debt consolidation is right for you, talk to a financial advisor or debt relief specialist.

How does debt consolidation help me?

Debt consolidation can be helpful in multiple ways, including making your debt payments more manageable and improving your credit score.

Here’s a short list of why you should consider taking out a debt consolidation loan if you are struggling with your debt.

Simplify your monthly payments

Debt consolidation can make your regular payments more manageable. For example, let’s assume you have four different high-interest loans (payday loans, personal loans, etc.). Each of these loans has $1000 outstanding, and the interest rates are more than 15% each.

You may be able to consolidate debt and take out a single $4000 loan at a much lower interest rate. This will help bring down your payments and make it easier to pay off your debts.

Improve your credit score

Following the previous example, if you have lower interest rates on a single loan, you should also have lower monthly payments. This means that it’s more likely that you will be able to make your payments on time, which will help your credit score.

Pay off your debt faster

Another benefit to a debt consolidation loan is that it can help you become debt free faster. Lower minimum payments through a debt consolidation process can put you on track to be debt free in a much shorter amount of time.

Get a longer repayment term

Other borrowers may have a different goal. Getting a debt consolidation loan can also give you the option to extend the repayment term. This means you could potentially have much lower debt payments over a more extended period. This can be good for your monthly cash flow, but you need to avoid taking on other debt or deprioritizing paying off your loans.

Regain control over your finances

Finally, the mental strain of having a high debt load with no end in sight can be challenging for people to deal with. Setting up a single monthly payment at a better interest rate can offer debt relief and make it easier to sleep at night.

The drawbacks to debt consolidation

While consolidating your debts is almost always a good thing, there are some watchpoints you need to be aware of before working with a debt consolidation service:

It can lead to overspending

If you have developed a habit of overspending, it can be challenging to break. You may be looking at debt consolidation services because your loan balances are too high, and you need relief.

However, when that relief comes, you risk sliding back into your old ways. And while the monthly payment pressure might be off, the total amount you owe hasn’t changed.

Suppose you aren’t disciplined with your spending. It can be easy to get yourself in trouble again. Still, it will be worse this time, given the higher loan balances and fewer available options.

It can extend the amount of time you will be in debt

When looking at debt consolidation options, the downside of changing your repayment schedule is that it can take longer to become debt free. While these are great borrowing solutions to manage your outstanding debts, you must focus on your payments to become debt-free sooner.

Longer payment timeframes can increase the chances of future problems, even with a more favorable payment schedule.

You may not save as much money as you think

Debt consolidation loans will save you money on your monthly payments but won’t necessarily save you more in the long run. If you extend your payment window with a lower monthly payment, but you aren’t paying down the principal, the lower interest rate will not make up for the longer time paying for your loan.

Keep an eye on your payments and the total owing, so you don’t get a bad deal.

It could damage your credit score

Earlier in this article, we talked about how debt consolidation loans can help your credit score. However, if something changes after you consolidate debts and you stop making regular payments, it can have the opposite effect.

If you are looking at consolidation loans, consider how important regular payments are to your credit rating.

You may not qualify for a debt consolidation loan

Finally, you may not qualify for this type of loan. Each lender has its own criteria for issuing a loan of this type, and you may not have the credit rating or income they are looking for.

If this happens, look at working with a credit counselor to investigate other options. These are professionals who specialize in helping people fix their credit issues and often can provide sound advice on how to approach debt consolidation.

What lenders offer debt consolidation loans

Many different types of lenders offer debt consolidation services. Here are a few of the most common ones:

Banks

Banks are the most common type of lender and offer debt consolidation services to their customers. They typically have lower interest rates and longer repayment terms than other types of lenders.

Credit unions

Credit unions are another option for debt consolidation loans. Like banks, they usually offer lower interest rates and longer repayment terms. However, you are more likely to get a personalized experience than you might otherwise with a big bank.

Peer-to-peer lending

Peer-to-peer (P2P) lending is a relatively new way to borrow money. With P2P lending, you borrow money from individuals or groups of individuals rather than from a bank or other financial institution.

P2P lending usually has higher interest rates than traditional debt consolidation loans from banks or credit unions. Still, it may be a good option if you have trouble qualifying for a loan from these institutions.

Debt consolidation companies

Some companies specialize in debt consolidation. These companies usually work with your creditors to negotiate lower interest rates and monthly payments. They may also be able to help you get a longer repayment term.

What to look for in a debt consolidation loan

Many different lenders offer borrowing solutions if you want to consolidate debt. Here are a few things to look for when evaluating which loan is best for your personal situation:

Interest rate

The first thing you’ll want to compare is each lender’s interest rate. This will impact the amount of money you’ll ultimately repay, so getting the best rate possible is critical.

There are many lenders out there that offer a variety of different interest rates. Start with the companies offering the lowest rates and then review terms to find the best combination of the two.

Loan terms

The next thing to consider is the length or term of each loan. A longer loan will have lower monthly payments but will cost you more in interest over time. Conversely, a shorter loan will have higher monthly payments but save you money on interest in the long run. It’s essential to evaluate what’s best for your individual needs before deciding.

Repayment options

As we mentioned earlier, debt consolidation loans can offer flexibility in how and when you make your payments. Some lenders will allow you to choose your own payment date, while others may have a set schedule. Consider what would work best for you before taking out a loan.

How to get a debt consolidation loan

If you are looking to take out a debt consolidation loan, there are a few steps in the process that you will want to follow:

Research lenders

The first thing you’ll want to do is research debt consolidation lenders to find the best option for your needs. Be sure to compare interest rates, loan terms, repayment options, and any other important features.

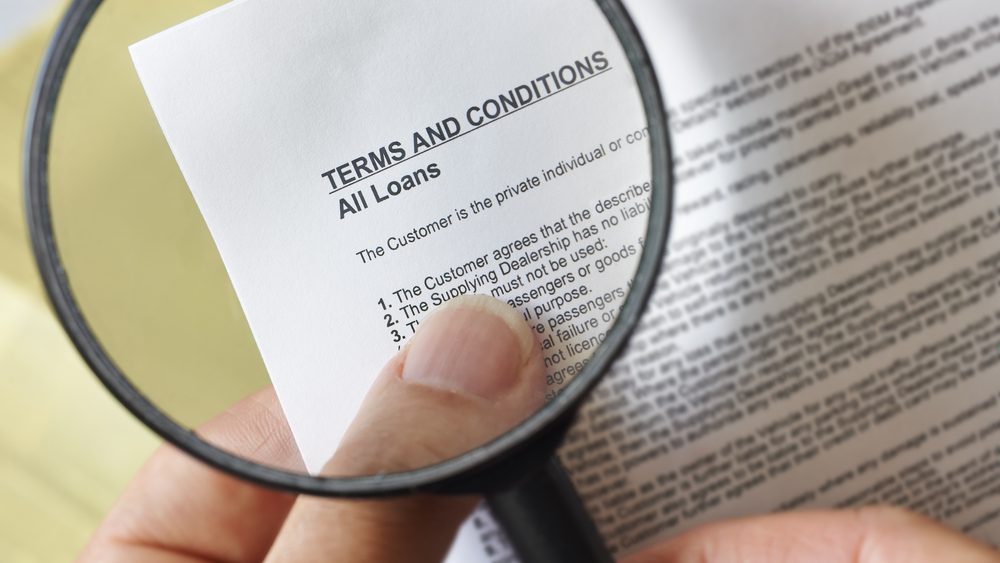

Review the loan terms

Check the loan terms carefully before signing any paperwork. Make sure you understand the interest rate, repayment schedule, and any fees or penalties associated with the loan. The last thing you need at this point is to sign up for a loan that will cause you more headaches in the future.

Check Your Credit Score

Your credit score will play a big role in determining whether or not you qualify for a debt consolidation loan. The higher your score, the better your chances of getting approved.

Apply for the Loan

Once you’ve found a lender you’re interested in working with, it’s time to apply for the loan. This process will vary depending on the lender but typically involves filling out an online application and providing some financial information.

If everything goes according to plan, you should get approved for your debt consolidation loan.

What to do if you can’t get a debt consolidation loan

So you’ve been rejected for a debt consolidation loan. Now what? Well, you still have options. Here are some of the things you should do next to help fix your financial situation:

Negotiate with your creditors

If you don’t qualify for a debt consolidation loan, you may still be able to negotiate with your creditors to get a lower interest rate or monthly payment. This is especially true if you’ve been a good customer in the past and have always made your payments on time.

Consider a balance transfer credit card

Another option is to transfer the balances of your high-interest credit cards to a low-interest or 0% APR balance transfer credit card. This can help you save money on interest and get your debt under control.

Look into peer-to-peer lending

If all else fails, you can try looking into peer-to-peer (P2P) lending as a last resort. P2P lending platforms are websites or services that allow people to borrow money from others. This can be a great option if you have a good credit score and are looking for a lower interest rate than you would find at a traditional bank.

Get help from a debt relief specialist

If you’re unable to get a loan and struggling to get out of debt, you may want to consider debt relief. This is a process where you work with a debt relief specialist to negotiate with your creditors and come up with a plan to lower your monthly payments or pay off your debt over time.

It’s essential to do your research and only work with a reputable debt relief specialist.

Consider bankruptcy

If you’re unable to get a loan and debt relief doesn’t seem viable, you may want to consider bankruptcy. This should be viewed as a last resort, as it will negatively impact your credit score. Only go down this path if there are no other options available.

How to avoid debt consolidation scams

Debt consolidation can be a helpful tool to get your finances back on track. However, many debt consolidation scams out there can leave you in a worse position than you were before. Here are some things to look out for to avoid getting scammed:

Watch out for upfront fees

Be wary of companies that require upfront fees. Many reputable debt consolidation companies will not charge any fees until they have helped you consolidate your debt.

Companies looking to charge you before priding service may not actually be able to help you and might leave you in worse shape than when you started.

Check their reviews

In today’s day and age, it’s easy for anyone to leave a review for any company on the internet. If people have had a bad experience, you can be sure that they will be posting about it online. Sites like Twitter, Facebook, and any legitimate review service are excellent places to start.

Protect your personal information

Don’t give out personal information like your Social Security number or bank account information unless you are sure the company is legitimate. Do your research and make sure you are comfortable with them before engaging. If you get a hard sell or feel that they may not have your best interests at heart, look for another option.

Read your contract

Don’t sign any contract without reading it carefully first, and make sure you know what you are getting into. If you have an option to have a lawyer or paralegal read it for you, do it. If not, ask someone you trust to provide a second set of eyes. Signing a contract you don’t understand can have significant negative consequences for your life in the long run.

Conclusion

Debt consolidation is a helpful tool for borrowers who want to reduce their monthly payments and regain control over their finances. You can get a lower interest rate, longer repayment term, and save money on interest payments by consolidating your debts. However, debt consolidation should only be used if you’re disciplined enough to stick to your repayment plan.

Interested in a debt consolidation loan? Apply now!