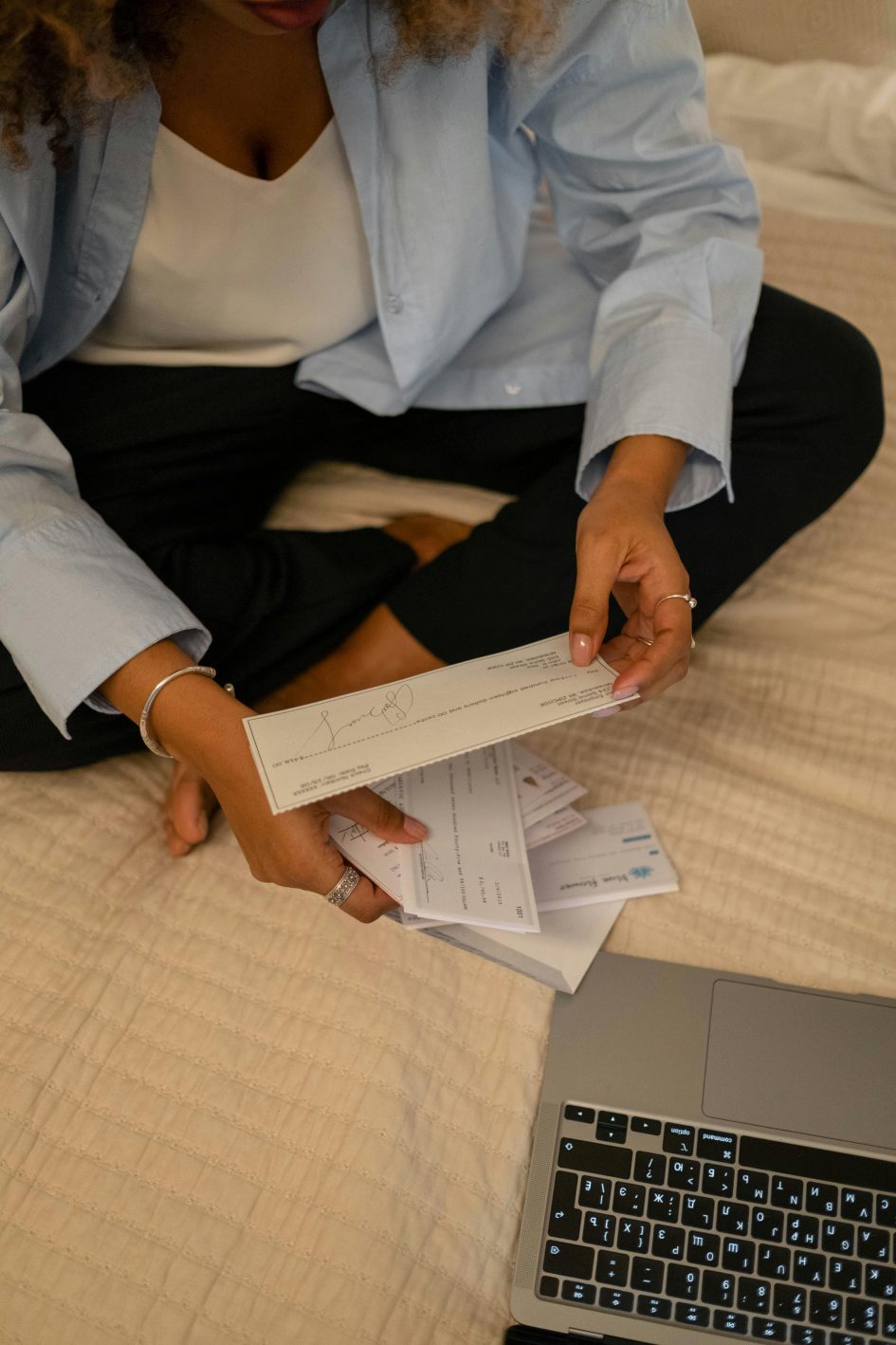

Writing a check may seem outdated in today’s digital world, but it’s still an essential skill to have for various transactions. Here is a detailed guide on how to write a check correctly to avoid any errors:

Step 1: Date the Check

Start by writing the date in the top right corner of the check. Use the format month/day/year (e.g., 11/08/2024) to ensure clarity. The date indicates when the check was written and is important for record-keeping purposes.

Step 2: Write the Payee’s Name

On the line labeled “Pay to the Order of,” write the full name of the person or business you are paying. Ensure the name is spelled correctly to avoid complications with processing the check.

Step 3: Enter the Payment Amount in Numbers

In the box on the right side of the check, write the amount you are paying in numerical form. For example, if the payment is for $150.75, write “150.75.” Make sure the numbers are clear and easy to read to prevent errors.

Step 4: Write the Payment Amount in Words

On the line below the payee’s name, write the payment amount in words. This step helps ensure that the correct amount is withdrawn from your account. For example, write “One hundred fifty and 75/100.” Start at the far left of the line and draw a line to the end to prevent any additions.

Step 5: Add a Memo (Optional)

The memo line at the bottom left is optional but useful for noting the purpose of the check. For example, you might write “Rent for November” or “Invoice #1234.” This helps both you and the payee keep track of the payment’s purpose.

Step 6: Sign the Check

Sign your name on the line at the bottom right to authorize the check. Without a signature, the check is not valid and cannot be processed. Use the same signature as the one on file with your bank to avoid issues.

Additional Tips for Writing Checks

- Use a pen: Always use a pen when writing a check to prevent alterations.

- Keep your checkbook secure: Store your checkbook in a safe place to avoid fraud.

- Record your transactions: Keep track of your written checks in your checkbook register to monitor your account balance.

Common Mistakes to Avoid

When writing a check, avoid the following common mistakes to ensure your check is processed without any issues:

- Illegible handwriting: Write clearly to ensure the bank and the payee can read the details.

- Incorrect payee name: Double-check the spelling of the payee’s name.

- Mismatched amounts: Ensure the numerical and written amounts match to avoid check rejection.

By following these steps and tips, you can confidently write a check and ensure your payment is processed smoothly.