Today, many couples dream of having a fairy-tale wedding in a beautiful venue surrounded by friends and family. However, there’s always the small matter of paying for it. But if you are planning to take out a wedding loan to pay for it, make sure you read this first.

There are many things to consider when planning a wedding, and whether or not to take out a loan should be one of them. While weddings can be expensive, there are many cost-effective ways to make your dream a reality, regardless of your wedding budget or the savings in your bank account.

This article will cover details that drive the cost of a wedding, how to save on your wedding costs, how you can pay for it, and the basics of wedding loans.

How much does a wedding cost?

The average cost of a wedding in Canada is between $22,000 and $30,000. However, the cost of a wedding can vary greatly depending on a variety of factors, such as the location, size, and type of wedding.

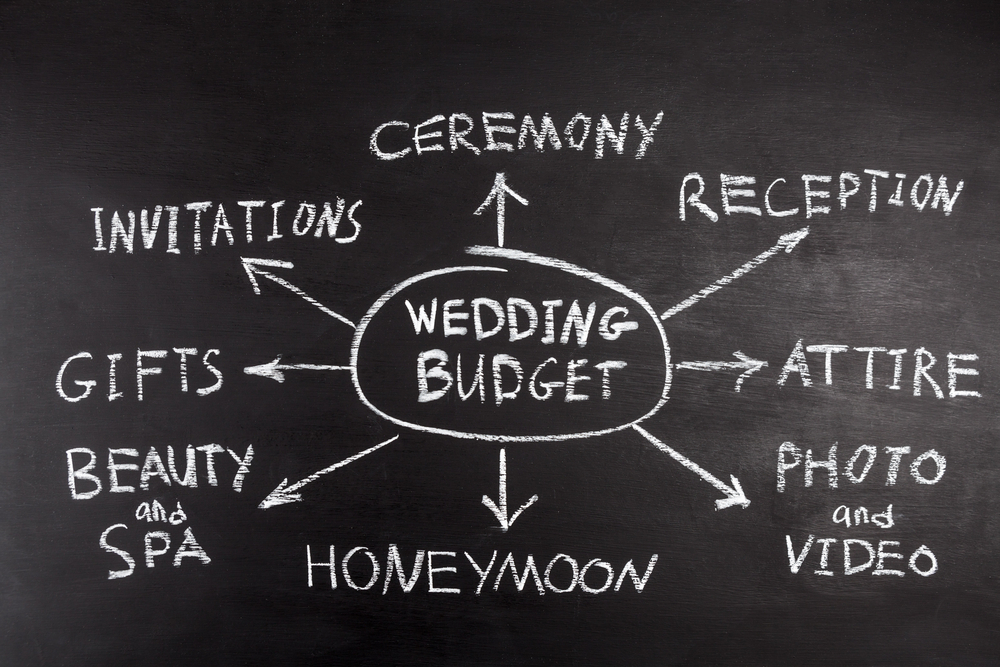

Here’s a look at the major wedding expenses that drive up the cost:

The venue

The cost of the venue is typically one of the most significant wedding expenses. Wedding venues can range from a few hundred dollars to several thousand dollars.

The catering

The cost of catering can also be a significant expense at a wedding. Catering costs can vary greatly depending on the number of guests, the menu, and the wedding location.

The flowers

Flowers can also be a large expense in a wedding. The cost will typically depend on the type of flowers, the number of bouquets/arrangements, and the size of the wedding.

The photography (and videography)

The cost of photography/videography can also add up quickly. Wedding photographers typically charge by the hour, and the cost can range from a few hundred dollars to several thousand dollars.

The music

The cost of the music will depend on the type of music. If you have a DJ, it will vary based on their hourly rate and the length of time they are working. If you plan to have a live band, it will depend on the number of musicians and the duration of the wedding.

The wedding dress

The cost of the dress will depend on the style, the designer, and where you purchase it. In Canada, the average wedding dress is approximately $1,500!

The tuxedo or suit

If the groom and groomsmen are wearing tuxedos or suits, the rental cost can add up quickly.

Other expenses

There are also several smaller expenses that can add up, such as the cost of the wedding invitations, the wedding cake, decorations, and transportation.

Why does a wedding cost so much?

Several factors contribute to the high cost of weddings.

The first is that weddings are often a once-in-a-lifetime event. As a result, couples often want to ensure that everything is perfect.

Another factor is that weddings have become increasingly elaborate over the years. In the past, weddings were often much simpler affairs. However, nowadays, weddings are often more like a production, with dedicated wedding planners and large budgets.

Finally, the cost of living has also increased significantly over the years. This means that the cost of everything from the venue to the flowers has also gone up.

How can I save money on my wedding?

There are many ways that you can reduce the cost of your wedding.

Cut the guest list

One of the easiest ways to save on your wedding is to cut the guest list. The more guests you have, the more expensive your wedding will be.

Choose a less expensive venue

If you’re looking to save funds on your wedding, one of the best places to start is the venue. Venues can be costly, so shopping around and comparing prices is essential. There are several ways to find affordable venues, such as by searching online or contacting your local chamber of commerce.

DIY your flowers

Another way to save on your wedding is to DIY your flowers. This can be a great way to be frugal, especially if you’re not picky about the type of flowers you use.

There are many ways to find affordable flowers, such as by searching online or visiting your local farmer’s market.

Get creative with your wedding dress

If you’re looking to save cash on your dress, one of the best places to start is by getting creative. There are a number of ways to find affordable dresses, such as by shopping second-hand or renting a dress.

Have a backyard wedding

If you’re looking for a more intimate and affordable option, consider having a backyard wedding. This can be a great way to save on your wedding venue.

Ask family and friends for help

Don’t be afraid to ask for help from family and friends when it comes to your wedding. There are many ways that they can help, such as helping with the food, decorations, or transportation.

What are the best ways to pay for your wedding

There are multiple ways to pay for your big day, such as:

Personal Savings

One of the best ways to pay for your wedding is with savings. If you’re able to save up for your wedding costs, you’ll be able to avoid taking on a new loan.

Credit cards

Another popular way to pay for weddings is with credit cards. This can be a great option if you’re able to pay off the balance quickly. However, this can come with significant downsides if you don’t, as the sky-high interest rates can bury you in bad credit card debt.

The “bank of Mom and Dad”

If you’re lucky enough to have parents or family members who are willing and able to help finance your wedding, this can be a great option. However, it’s essential to make sure that you can pay them back in a timely manner.

Wedding loans

Several online lenders offer loans that are designed for financing weddings and we are one of those firms. SkyCap Financial offers wedding loans to help ensure you have the nuptials of your dreams. We will help you get the loan amount you need with no origination fee.

We work with prospective borrowers by offering attractive loan terms, regardless of whether you have a strong credit history or not. We’ll help you quickly turn the loan proceeds into your dream wedding, regardless of your financial situation.

Let’s take a deeper look into this option:

What is a wedding loan?

A wedding loan is a personal loan that couples can use to finance their wedding. Wedding loans are used for various purposes, including paying for the engagement ring, wedding dress, honeymoon, and other related expenses. There are many wedding loan options out there, including us here at SkyCap.

How do wedding loans work?

Wedding loans are typically unsecured personal loans, which means they are not backed by collateral. This means that your home or car will not be used as security for the loan. Wedding loans typically have fixed interest rates and monthly payments.

What are the benefits of taking out a wedding loan?

There are a few benefits of taking out a wedding loan:

You can host your dream wedding

Suppose you have always wanted a large wedding but don’t have the wedding budget to pay for it. In that case, a wedding loan can help you make your dream wedding a reality, even if you are short of cash savings.

You can get a lower interest rate

Interest rates on personal loans can be lower than those on credit cards, depending on your lender and credit rating. You may be able to save on interest charges if you use a personal loan for your wedding costs instead of using plastic.

You can have fixed monthly payments

Most personal loan lenders will offer you fixed monthly payments. This means that you will know exactly how much you need to pay each month, and you can plan your budget accordingly.

You can pay off the loan early

Most personal loans have no prepayment penalties, which means you can pay off the loan early without incurring any fees. This is a great way to save on interest charges.

What are the disadvantages of taking out a wedding loan?

There are also a few disadvantages of taking out wedding loans:

You may need to have good credit

To qualify for a personal loan, you will typically need a good credit score. This means that if you have bad credit, you may not be able to get a wedding loan. Most lenders will have a minimum credit score requirement that you will need to meet before getting your loan approval.

You may not be able to get as much money as you need

Personal loans typically have lower borrowing limits than other loans, such as home equity loans. If you need to borrow a lot of money for your wedding, a personal loan may not be the best option.

You will have to pay interest on the loan

Personal loans typically have higher interest rates than other loans. This means that you will have to pay more in interest charges over the life of the loan.

You will have to make monthly payments

With a personal loan, you will have to make monthly payments. This can be a disadvantage if you are tight on cash flow or cannot make the payments on time.

You may not be able to get a tax deduction

Interest on personal loans is not tax-deductible. This means that you will not be able to deduct the interest charges on your taxes.

Should you take out a loan for your wedding?

There is no shortage of organizations that offer wedding loans. However, taking out a loan for your wedding is a personal decision. There are pros and cons to taking out a loan, and you will need to weigh the risks and benefits before making a decision. If you decide to take out a loan, shop around for the best interest rate and terms.

What should you look for in a wedding loan?

When looking for a wedding loan, you will want to consider the following elements:

The interest rate

The interest rate is significant when looking for the best wedding loans. You will want to look for a loan with the lowest interest rate possible to save on interest charges. It may also be worth looking at securing your loan if possible, as that’s always a better way to get preferential personal loan rates

The repayment term

The loan’s repayment term is also important. You will want to choose a loan with a repayment term that you are comfortable with. Most personal loans have terms of three to five years, but some lenders may offer longer options.

The monthly payment amount

The loan’s interest rate and repayment term will determine the monthly payment amount. You will want to make sure the monthly payment is an amount that you can comfortably afford so that you aren’t at risk of getting behind on your loan.

The fees

Some lenders may charge fees, such as origination fees or prepayment penalties. It goes without saying that when looking at loan options, you want to aim for the lowest possible fees. This rule applies whenever you borrow money and is a good rule of thumb when evaluating lenders.

The type of lender

It’s always best to look for a reputable lender to help you cover wedding costs. It’s best to avoid payday loan companies and work with a specialized lender like SkyCap, which can offer competitive interest rates. And as always, be sure to check the reviews before you sign on the dotted line.

Will a wedding loan impact my credit score?

Like borrowing money for other purposes, taking out a loan for your wedding will impact your credit score. When you apply for a loan, the lender will make a hard inquiry on your credit report, which can temporarily lower your credit score. However, if you make your payments on time and in full, your credit score will recover within a few months.

It’s also possible that a wedding loan could help your credit history. If you have poor credit and have a history of late payments, taking out a wedding loan and paying it back on time can help you rebuild a higher credit score.

How can I get a wedding loan if I have bad credit?

If you have a bad credit score, you may still be able to get a wedding loan. There are a few options available to people with poor credit:

You can apply for a personal loan with a cosigner

If you have poor credit, you may be able to get a personal loan by finding a cosigner with good credit. A cosigner is someone who agrees to sign the loan with you and is responsible for making the payments if you default on the loan.

You can apply for a secured loan

If you have poor credit, you may be able to get a secured loan. A secured loan is backed by collateral, such as a car or home. This means that if you default on the loan, the lender can take your collateral.

You can get a loan from a credit union

Credit unions typically have more lenient lending standards than banks. This means that you may be able to get a loan from a credit union even if you have bad credit.

You can get a SkyCap Personal Loan

At SkyCap, we specialize in loans for many different purposes. We can get you a quick approval with competitive rates if you are looking for a wedding loan. If you are interested, simply fill out our loan application to get started.

Final Thoughts

A loan can be a great way to finance your wedding day. However, it’s crucial to weigh the pros and cons before deciding whether to take one out. Make sure you shop around for the best interest rate and terms, and remember that taking out a loan will impact your credit score.

SkyCap specializes in loans for many different purposes, including weddings. Apply today to get started!